Objectives and instruments regulating foreign economic activities.

Trade is a universal activity whether conducted on an individual or a national level. There are, however, two special considerations of international trade. One is that since each nation maintains its own currency, international trade requires that a foreign exchange market be established for currencies. Second, there are the issues involving barriers to trade. Does it ever make sense to limit the number of cars we import from Japan? Should we require U.S. citizens to pay a higher price for Canadian products than for the same product made in the United States? There is much concern over the protection of domestic American industries. We should take the time to understand the economic aspects of international trade.

The exchange rateis the price of one currency in terms of another.

The nominal exchange rateis the relative price of the currency of two countries. When people refer to "the exchange rate" between two countries, they usually mean the nominalexchange rate.

A nation's exports create a foreign demand for national currency, and the satisfaction of this demand generates a supply of foreign monies held by national banks and available to national buyers. Conversely, a nation's imports simultaneously create a domestic demand for foreign exchange and make a supply of national currency available to foreigners. The fulfillment of this demand reduces the supplies of foreign monies held by national banks.

Figure 15.2 Dynamics of the exchange rate the Kazakhstan tenge for 1993-2007гг*.

.

.

The price of a foreign currency, r, should be raised by:

- a rise in the home country's money supply M;

- a drop in the foreign country's money supply;

- a rise in the foreign country's real income (Yf);

- a drop in home country's real income (Y);

- a rise in the foreign country's interest rate (if);

- a drop in the home country's interest rate (i);

- a rise in the home country's expected inflation rate (πe);

- a drop in the foreign country's expected inflation rate (πef);

- a drop in the home country's trade balance.

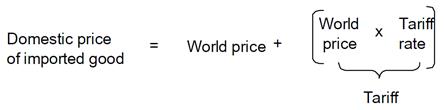

Trade policy- tariffs, export subsidies, import quotas, and other means a government may employ to reduce imports and expand exports. The most widely used trade barrier is the tariff- a tax imposed on an imported good. Protective tariffs increase the domestic prices of imported goods.

Figure 15.3 The effect of a tariff.

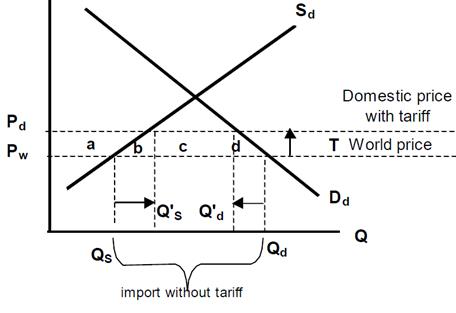

The strongest arguments for protection are the infant-industry and military self-sufficiency arguments. Other arguments for tariffs (increase domestic employment, diversification for stability, etc.) are usually second-best solutions. A production subsidy or consumption tax would achieve the objective at lower social cost. In case of the production subsidies consumers do not lose the additional area d

Figure 15.4 The effect of a subsidies.

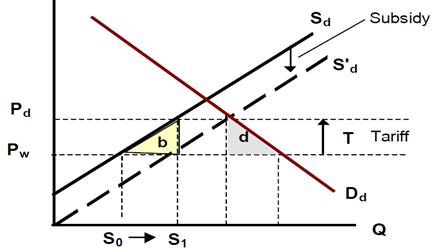

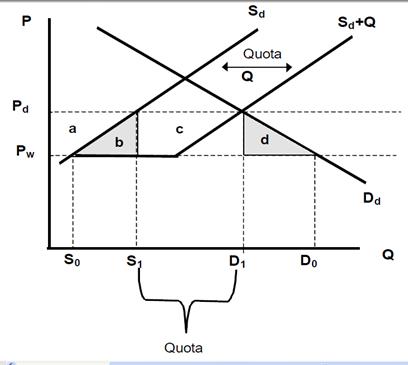

Tariffs are not the only form of trade policy. The most prevalent nontariff trade barrier is the import quota, a limit on the total quantity of imports allowed into a country each year. The government gives out a limited number of licenses to import items legally and prohibits importing without a license.

Figure 15.4 The effect of a quota

Дата добавления: 2015-10-05; просмотров: 1038;