The land market. Demand and supply of land. Land rent. The price of land.

InvestmentFirms’ purchases of new capital over some period of time.

How does a business firm decide how much physical capital to buy? In the same way that it makes any other decision. The firm’s goal is to maximize its profit—not just this year, but over many years into the future. But in trying to select the best quantity of capital to purchase, the firm faces constraints.

First, the firm faces some given technology, as represented by its production function. The technology tells us how much output the firm can produce with each quantity of capital it might purchase and put in place.

Second, the firm faces a constraint on the price it can charge for its output. This constraint is determined by the demand curve it faces. As we did when we studied labor markets, we’ll keep our analysis simple by assuming that firms sell their output in perfectly competitive product markets. That is, each firm takes the price of its product as a given.

Finally, the firm must pay for its capital, just as it must pay for its other inputs. Here again, we’ll assume that it faces a perfectly competitive market for physical capital. As a consequence, the firm takes the market price of the capital it buys as a given.

As the interest rate rises, each business firm in the economy—using the principle of asset valuation—will place a lower value on additional capital, and decide to purchase less of it. Therefore, in the economy as whole, a rise in the interest rate causes a decrease in investment expenditures.

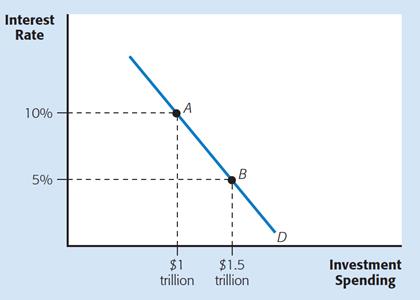

The relationship between the interest rate and investment expenditure is illustrated by the economy’s investment curve, shown in Figure 1.

Investment demand curveIndicates the level of investment spending firms plan at various interest rates.

The curve slopes downward, indicating that a rise in the interest rate causes investment spending to fall.

Rate of interest is the price, paid to the proprietor of the capital for use of its means during the certain period of time.

Real interest rateThe annual percent increase in a lender’s purchasing power from making a loan.

So far in this chapter, we’ve explored investment in physical capital. But now let’s consider investment in human capital—the skills and abilities of the workforce. Like physical capital, these skills and abilities are long-lasting tools that make labor more productive in producing output. But unlike physical capital—which is owned by firms—human capital is ordinarily possessed by individual workers.

Net investmentTotal investment minus depreciation.

DepreciationA decrease in the price of a currency in a floating-rate system.

One exception is depreciation, a charge for the gradual wearing out of the firm’s plant and equipment.

Accountants include this as a cost even though no money is actually paid out.

Дата добавления: 2015-10-05; просмотров: 1348;