THE WORKBOOK

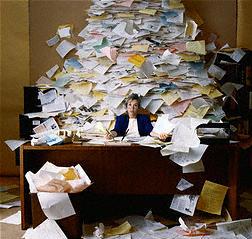

Accounting projects generate lots of paperwork. Accounting paperwork needs to be tied down. Otherwise people tend to misplace them when they look something up. In busy offices paperwork does tend to wander.

Accounting projects generate lots of paperwork. Accounting paperwork needs to be tied down. Otherwise people tend to misplace them when they look something up. In busy offices paperwork does tend to wander.

Reports are punched and put into binders. After each period is closed, print out the reports and file them in the same binder as the previous period in their proper order. The system presumes outputfrom laser printers. Index tabs separate the major sections.

1. Chart of Accounts. This chart is the structure of your accounting system. It lists the ID number and the name for each account. Accountants will consult it often for data entry. Managers will use it as a roadmap to understand the General Ledger and the rest of the accounting reports.

2. Financial Statements. Keep all the statements together in one section. Readers need to be able to quickly refer to the Balance Sheet while reading the Income Statement and vice versa.

3. General Ledger. This shows the debits and credits that make up the balances on the financial statements.

4. General Journal. This shows the adjust entries.

5. Bank Reconciliations. Include here the copies of each bank statement as well as the schedule that shows how the ending balance relates to the General Ledger. Other papers that contain calculations for Adjusting Journal Entries that come out the bank reconciliation process should go here, too.

6. Cash Journals. Software may kick out a number of reports here. Traditional reports include the Cash Receipts Journal and the Cash Disbursements Journal.

7. Accounts Receivable (A/R) Reports. First comes an Aging Schedule. This breaks out A/R by customer and invoice. It also shows how long each debt has been out there. This is a must-see report for management. The other major report is the Sales Journal.

8. Accounts Payable (A/P) Reports. Similar to the A/R reports, the Aging Schedule shows how much your company owes vendors and for how long. The Purchase Journal belongs here.

9. Payroll Reports. There should be a Payroll Ledger and a Payroll Journal.

10. Job Cost Reports. If a company has a cost accounting system in place, these reports will show revenues and expenses for each job that the company is working on. Management will turn to this section to see which jobs are making money and which aren’t. Other reports will show which jobs are over budget and which aren’t.

This is a workbook for accounting reports, only. Tax Returns including payroll tax returns, property tax returns, and sales tax returns belong in separate files. Personnel records belong in a separate file, not behind the Payroll tab.

Accounting reports can be quite lengthy even for small companies. A binder can fill up surprisingly rapidly. Because people will need to refer back to these reports often, a binder can protect the papers and keep them together. After a year has passed, and the tax returns done, the need to refer back to these reports falls back dramatically.

Retention rules are three years for most cases. Some accountants insist on saving these reports for 7 years. You may want to save them longer.

There are many other systems for organizing paperwork.

Дата добавления: 2015-10-19; просмотров: 959;