DEPRECIATION

Depreciation is an annual deduction that businesses can claim for the cost of fixed assets. Depreciation includes deterioration from use, age, and exposure to the elements, as well as decline in value caused by obsolescence, loss of usefulness, and the availability of newer and more efficient means of serving the same purpose. It does not include sudden losses caused by fire, accident, or disaster. Depreciation is often used in assessing the value of property (e.g., buildings, machinery) or other assets of limited life (e.g., a leaseholdor copyright) for tax purposes.

Depreciation is an annual deduction that businesses can claim for the cost of fixed assets. Depreciation includes deterioration from use, age, and exposure to the elements, as well as decline in value caused by obsolescence, loss of usefulness, and the availability of newer and more efficient means of serving the same purpose. It does not include sudden losses caused by fire, accident, or disaster. Depreciation is often used in assessing the value of property (e.g., buildings, machinery) or other assets of limited life (e.g., a leaseholdor copyright) for tax purposes.

The cost of assets that are totally consumed within an accounting period will be recognized as an expense within that period. When an asset is not totally consumed within a single accounting period as is typically the case with fixed assets the cost of the asset must be allocated as an expense over the periods in which the asset is consumed. The depreciation for an asset in a period is simply an estimate of the portion of the original cost to be assigned as an expense to the period. A similar concept is depletion, which is applied to the extraction of natural resources in recognition of the fact that a certain part of the natural resource has been consumed during a given period.

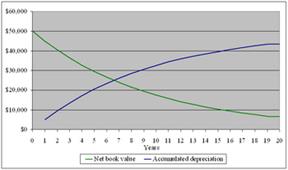

For historical cost purposes, assets are recorded on the balance sheet at their original cost; this is called the historical cost. Historical cost minus all depreciation expenses recognized on the asset since purchase is called the book value. Depreciation is not taken out of these assets directly. It is instead recorded in a contra asset account: an asset account with a normal credit balance, typically called "accumulated depreciation". Balancing an asset account with its corresponding accumulated depreciation account will result in the net book value. The net book value will never fall below the salvage value, meaning that once an asset is fully depreciated, no further expenses will be taken during its life.

Recording a depreciation expense will involve a credit to an accumulated depreciation account. The corresponding debit will involve either an expense account or an asset account which represents a future expense, such as work in process. Depreciation is recorded as an adjusting journal entry.

There are several methods for calculating depreciation, generally based on either the passage of time or the level of activity (or use) of the asset: straight-line depreciation; accelerated depreciation; sinking fund method; a declining-balance method; sum of years digits depreciation, etc.

Depreciation is an expense, and it affects taxes by reducing taxable income. A firm may use different depreciation treatments for tax purposes and for financial statements. Typically, straight-line depreciation would be used for financial reporting because it produces more consistent earnings and is easily understood. An accelerated depreciation treatment would be chosen for tax accounting because the higher depreciation in early periods results in lower taxable income, and shifts tax payment to later periods when lower depreciation results in higher taxable income. This is solely a timing advantage. The total amount of taxes paid is not reduced, but a portion of the payments is shifted to later periods.

Дата добавления: 2015-10-19; просмотров: 1036;